Your credit score is a huge factor that lenders use in determining whether or not to give you a loan. It's important for you to understand your credit history and how it affects your credit score. Only then can you take steps toward improving your credit.

What is a Credit Score?

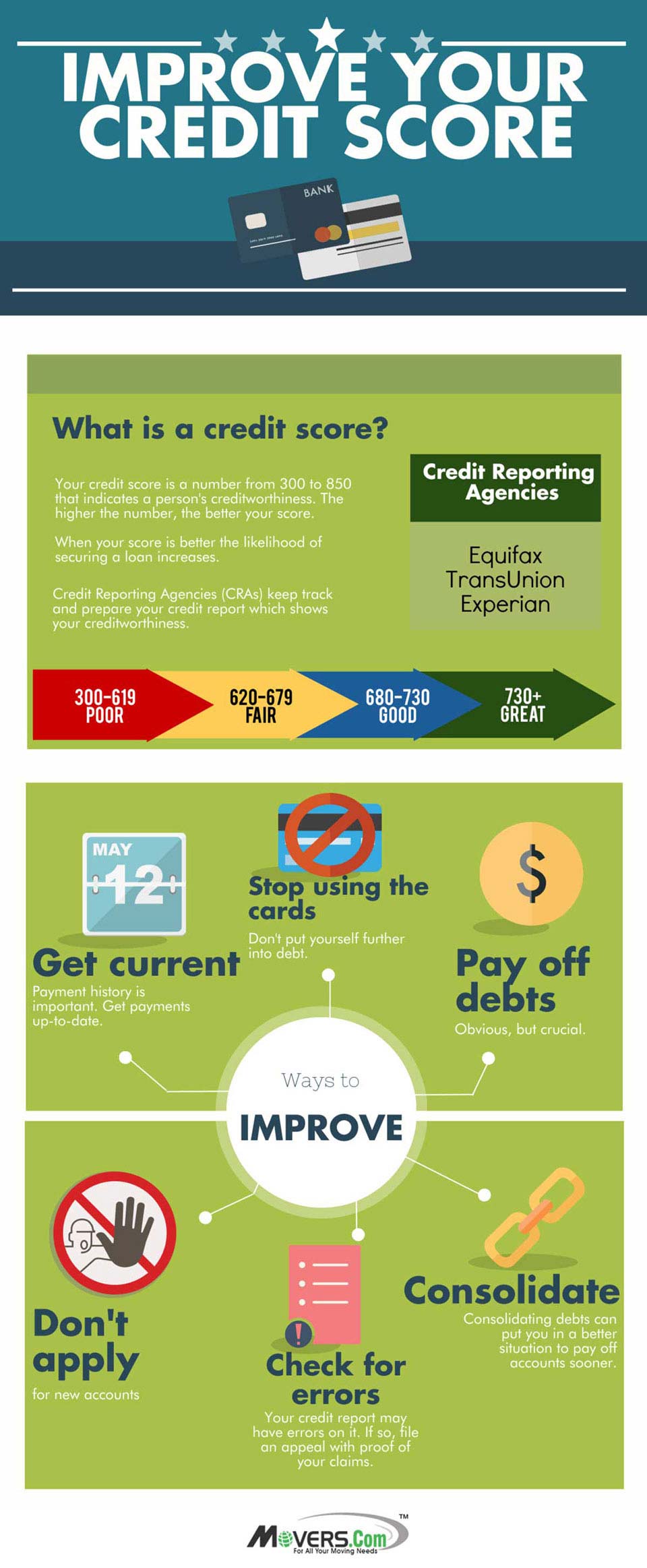

A credit score is a number varying from 300 to 850 that indicates a person's creditworthiness. The higher the number, the better your credit is and the more likely you'll be able to secure a favorable loan. A low credit score might restrict you to high interest rates or make it nearly impossible for you to secure a loan at all.

Any banks or other financial institutions that you interact with keep track of those interactions (i.e., payments and other account activity). That information is then traced by companies called Consumer Reporting Agencies (CRAs) that prepare your

credit report, which will show your credit score and more specific information about your creditworthiness (e.g., whether or not you pay on time or if you have a lot of outstanding debt).

Did You Know?

The three major CRAs are Equifax, Experian, and TransUnion. They score your credit using the FICO scoring model, which is named after Fair, Isaac and Company, the organization that developed it.

How to Improve Your Credit

Improving your credit score isn't a quick or necessarily easy task; it will require some time and discipline on your part. The best way to get started is to get a copy of your credit report. Then, you'll know what you're dealing with and what specific areas you need to work on. Here's some advice for improving your credit:

- Avoid or stop using your credit cards – Putting yourself further into debt is the last thing you want to do if your credit is already bad.

- Fix your credit report – It's possible that your credit report contains some errors. If it does, you'll have to file an appeal and, of course, be able to prove your claims.

- Get current – Your payment history is one of the most important contributing factors to your credit score. You'll look a lot better if you get up to date on your delinquent accounts.

- Pay off your debts – This may seem pretty obvious, but it's also crucial.

- Check before you close an account – Closing out delinquent credit card accounts isn't necessarily a good idea. Doing so can actually negatively affect your credit, so make sure it won't before you close an account.

- Don't apply for any new loans or credit cards – If you're dealing with debt, it probably isn't the time to be putting in applications for more loans or credit cards.

- Consolidate – While you don't want to open new accounts, consolidating your debts can put you in a better position to get things paid off.

Having good credit is essential for so many things; whether it's getting credit cards, mortgages, or car loans, good credit is only going to help you. Improving your credit may force you to make cutbacks in other areas and will surely require you to be financially responsible, but doing so is essential to putting yourself in good financial standing.